Hey, I’ve not only seen this movie before, I did some script treatments:

Chief Executive Officer John Chambers is aggressively pursuing software takeovers as he seeks to turn a company once known for Internet plumbing products such as routers into the world’s No. 1 information-technology company. … Cisco is primarily targeting developers of security, data-analysis and collaboration tools, as well as cloud-related technology, Chambers said in an interview last month.

Good for them. Cisco has consistently done a good job to fill out its portfolio and is far from the one-trick pony people think it is (last I checked, they do well with converged infrastructure, or integrated systems, or whatever we’re supposed to call it now). They actually have a (clearly from lack of mention in this piece) little known-about software portfolio already.

In case anyone’s interested, here’s some tips:

1.) Don’t buy already successful companies, they’ll soon be old tired companies

Software follows a strange loop. Unlike hardware where (more or less) we keep making the same products better, in software we like to re-write the same old things every five years or so, throwing out any “winners” from the previous regime. Examples here are APM, middleware, analytics, CRM, web browsers…well…every category except maybe Microsoft Office (even that is going bonkers in the email and calendaring space, and you can see Microsoft “re-writing” there as well [at last, thankfully]). You want to buy, likely, mid-stage startups that have proven that their product works and is needed in the market. They’ve found the new job to be done (or the old one and are re-writing the code for it!) and have a solid code-base, go-to-market, and essentially just need access to your massive resources (money, people, access to customers, and time) to grow revenue. Buy new things (which implies you can spot old vs. new things).

2.) Get ready to pay a huge multiple

When you identify a “new thing” you’re going to pay a huge multiple of 5x, 10x, 20x, even more. You’re going to think that’s absurd and that you can find a better deal (TIBCO, Magic, Actuate, etc.). Trust me, in software there are no “good deals” (except once in a lifetime buys like the firesale fro Remedy). You don’t walk into Tiffany’s and think you’re going to get a good deal, you think you’re going to make your spouse happy.

3.) “Drag” and “Synergies” are Christmas ponies

That is, they’re not gonna happen on any scale that helps make the business case, move on. The effort it takes to “integrate” products and, more importantly, strategy and go-to-market, together to enable these dreams of a “portfolio” is massive and often doesn’t pan out. Are the products written in exactly the same programming language, using exactly the same frameworks and runtimes? Unless you’re Microsoft buying a .Net-based company, the answer is usually “hell no!” Any business “synergies” are equally troublesome: unless they already exist (IBM is good at buying small and mid-companies who have proven out synergies by being long-time partners), it’s a long-shot that you’re going to create any synergies. Evaluate software assets on their own, stand-alone, not as fitting into a portfolio. You’ve been warned.

4.) Educate your sales force. No, really. REALLY!

You’re thinking your sales force is going to help you sell these new products. They “go up the elevator” instead of down so will easily move these new SKUs. Yeah, good luck, buddy. Sales people aren’t that quick to learn (not because they’re dumb, at all, but because that’s not what you pay and train them for). You’ll need to spend a lot of time educating them and also your field engineers. Your sales force will be one of your biggest assets (something the acquired company didn’t have) so baby them and treat them well. Train them.

5.) Start working, now, on creating a software culture, not acquiring one

The business and processes (“culture”) of software is very different and particular. Do you have free coffee? Better get it. (And if that seems absurd to you, my point is proven.) Do you get excited about ideas like “fail fast”? Study and understand how software businesses run and what they do to attract and retain talent. We still don’t really understand how it all works after all these years and that’s the point: it’s weird. There are great people (like my friend Israel Gat) who can help you, there’s good philosophy too: go read all of Joel’s early writing of Joel’s as a start, don’t let yourself get too distracted by Paul Graham (his is more about software culture for startups, who you are not — Graham-think is about creating large valuations, _not_ extracting large profits), and just keep learning. I still don’t know how it works or I’d be pointing you to the right URL. Just like with the software itself, we completely forget and re-write the culture of software canon about every five years. Good on us. Andrew has a good check-point from a few years ago that’s worth watching a few times.

6.) Read and understand Escape Velocity

This is the only book I’ve ever read that describes what it’s like to be an “old” technology company and actually has practical advice on how to survive. Understand how the cash-cow cycle works and, more importantly for software, how to get senior leadership to support a cycle/culture of business renewal, not just customer renewal.

7.) There’s more, of course, but that’s a good start

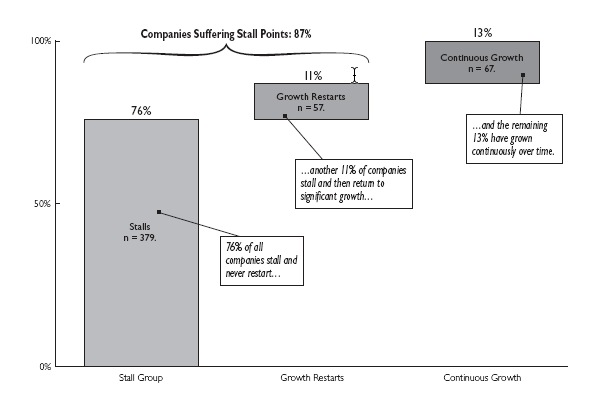

Finally, I spotted a reference to Stall Points in one of Chambers’ talks the other day which is encouraging. Here’s one of the better charts you can print out and put on your wall to look at while you’re taking a pee-break between meetings:

That charts all types of companies. It’s hard to renew yourself, it’s not going to be easy. Good luck!